HSBC Life UK is growing its value-added benefits to include policyholders’ partners, which includes spouses, civil partners and cohabiting partners.

The lender said that the change to its value-added benefits was part of its “ongoing commitment to providing wellbeing and peace of mind for customers”.

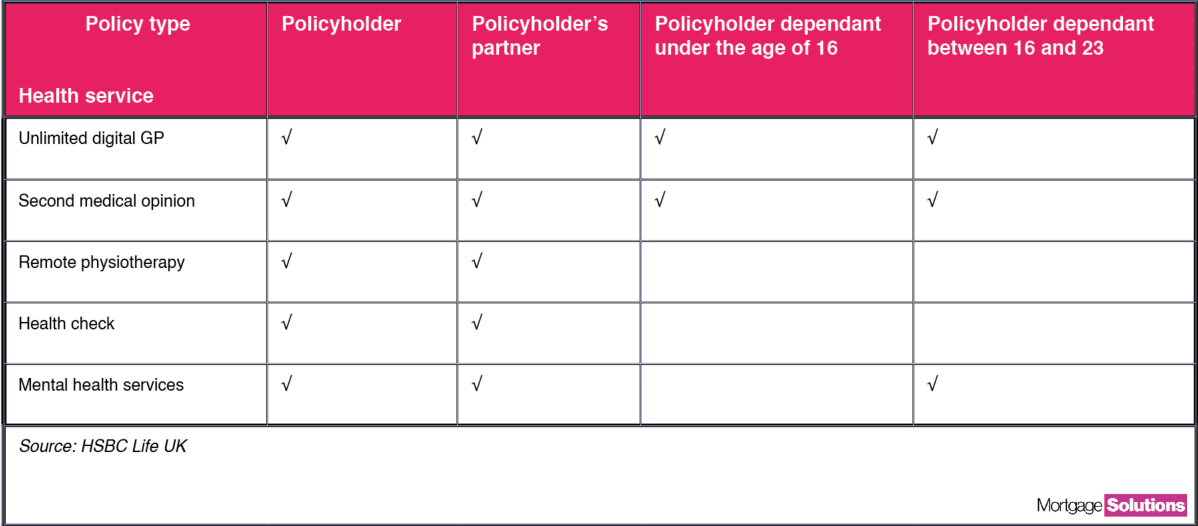

The value-added benefits include mental health services, unlimited 24/7 digital GP appointments, second medical opinions, remote physiotherapy, and an annual health check.

They are available to existing and new protection customers who bought cover through intermediary distribution partners. This includes price comparison websites.

Policyholder dependents will also be able to secure digital GP appointments and second medical opinions. Dependents aged 16-23 will be eligible for mental health services.

Allowances are shared between all family members who have access, with digital GP appointments being unlimited, second medical opinions capped at two per year, remote physiotherapy limited to eight, health checks limited to one per year and mental health service appointments limited to eight per year.

Richard Waters, head of protection distribution at HSBC Life (UK) Ltd, said: “We understand the importance of staying at the forefront as a leading protection provider. That’s why we are constantly evolving our protection proposition.

“We believe it is really important that our customers are able to maintain their wellbeing by knowing how to access and use these value-added benefits. As such, we distribute a reminder on the six-month anniversary of customers’ policies, and we include details of the benefits in their annual statements. We want our customers to use these services for prevention rather than cure.”

Anna is currently the deputy editor for Mortgage Solutions and editor for Specialist Lending Solutions. She has worked as a journalist since 2019, having secured her Gold Standard NCTJ diploma from News Associates in a fast-track six-month course.

She started her career as a report at specialist publication The Insurance Insider covering a wide range of areas before joining Mortgage Solutions and Specialist Lending Solutions in 2021.

In her role, she helps put together and structure the news agenda for the day and writes up press releases, reports, interviews, analyses and exclusives across both titles. She also commissions blogs for Specialist Lending Solutions and hosts online masterclasses and in-person events across the business.

She has been shortlisted for three journalism awards, which include BIBA Journalist and Media Awards Scoop of Year Award in 2020, Headline Money Mortgage Journalist of the Year Award (B2B) in 2022 and 2023.

Prior to being a journalist, Anna worked in ecommerce across Snow + Rock, Cycle Surgery and Runners Need websites, and before that worked at specialist financial PR firm Rostrum.

In her spare time, Anna enjoys reading, seeing live music, and cooking for friends and family. When she gets a chance, she also enjoys hiking, skiing and indoor rock climbing.